Are you ever just driving to work and find yourself thinking about the stock market? No? Just me? In my defense my commute is really long, and sometimes I run out of podcasts, audio books, etc.

Anywho…

… the other day it occurred to me that I don’t yet own any pet-related stocks. I couldn’t believe it! If anyone owns them it should be an enthusiastic dog mom like myself, right?

My Thoughts on Investment

You may not know, but I have a day job and I am a Global Marketing Manager at an early-stage global startup accelerator called the Founder Institute (PetHub is actually a graduate of our program!). Since starting my job here in 2016, I have learned a lot about market trends, startups, investments, etc. and I have been so fortunate to work with companies in the veterinary and pet industries.

In the past year, I have made strides to improve our investment strategies and I want to focus on companies and industries that I use and believe in. Essentially, I want to put my money where my mouth is…so to speak. I want to make it clear that I am not an investor nor am I a professional stock trader, I just want to get people excited about the pet industry so that it grows!

After having this epiphany in the car last week, I knew exactly what to do next. I am fortunate in my job to know a lot of great startup founders and people in different industries. One of these great individuals is Hoda Mehr who is the Founder and CEO of Stockcard.io, a platform that makes investing in stocks easier and more discernible. When I arrived at work last week, I immediately reached out to Hoda (also a very proud dog mom, see a photo of Hoda and her dog Kratos below) and asked her opinion on pet-related stocks and investments to see if she had any suggestions for a dog mom like myself.

Hoda broke it down for me, and said that there are 3 Pillars to consider when it comes to a Pet-Related Investment Strategy:

1) Health for Pets

2) Urban life for Pets

3) Pet Technology

Let’s “dig” in a little further

Health for Pets

This is the category with the most current opportunity for investment in the stock market. Meaning, many of the companies that are used in the veterinary industry, etc. are publicly traded and, therefore, as a consumer you can participate in the company’s success (or failure, but hopefully success).

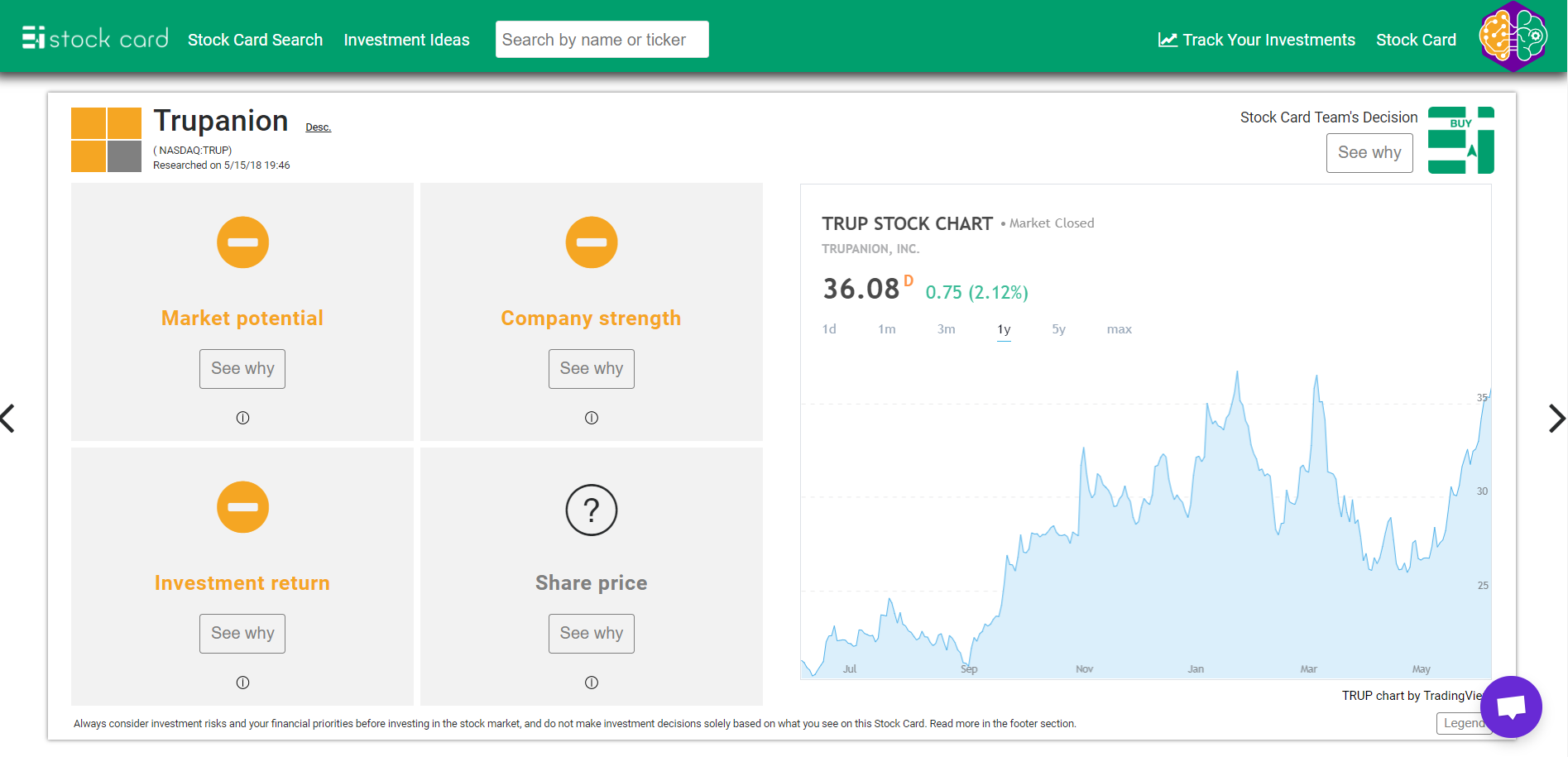

One of the companies that I was most excited to purchase stocks from was Trupanion (symbol: TRUP)! Long-time readers of MKHP know very well that Trupanion is the pet insurance I have for Rooney and, therefore, a no-brainer for me as an investment strategy. I truly believe in pet insurance and have seen it grow in popularity significantly in the U.S. in the last 15 years, and hope to participate in the growth of this industry in the future!

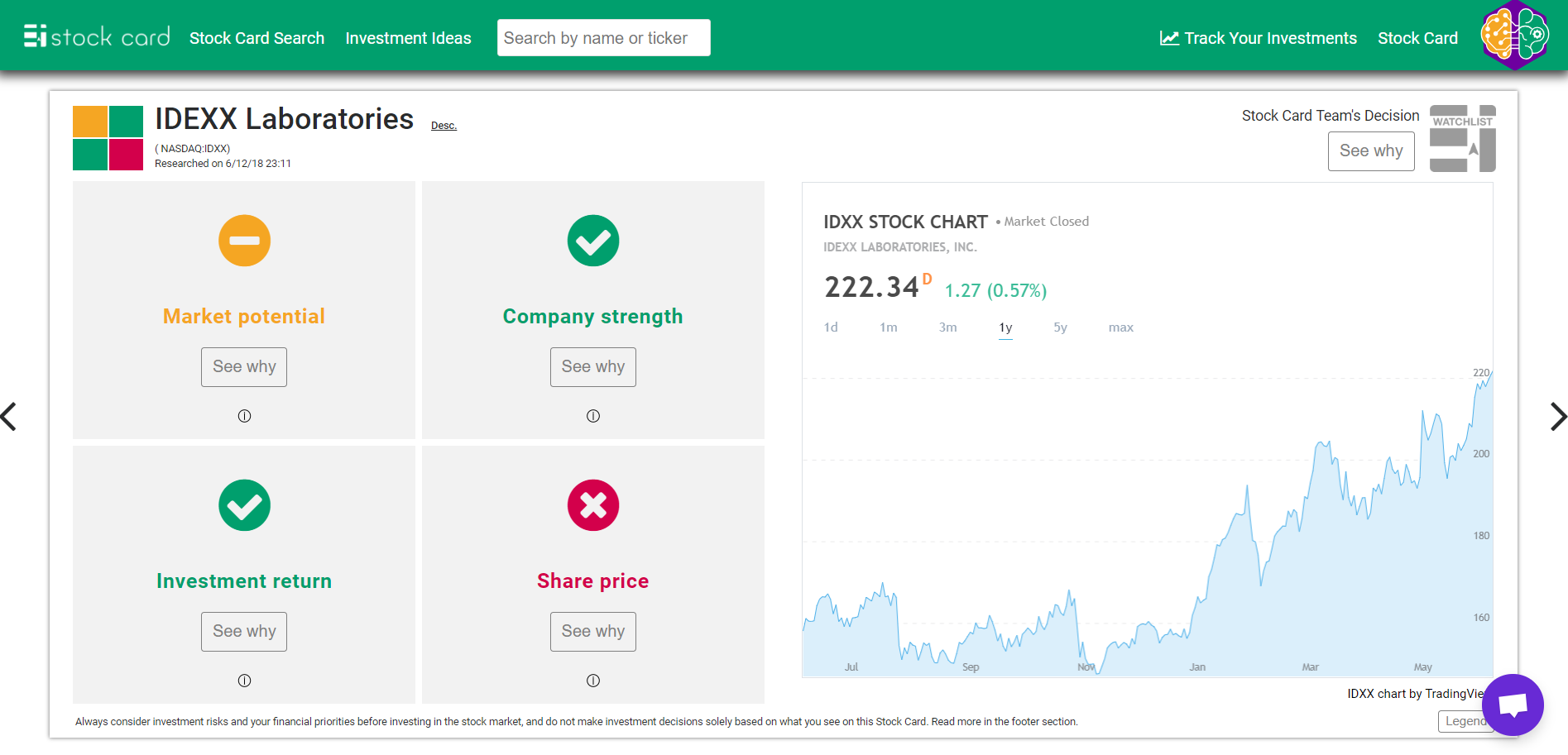

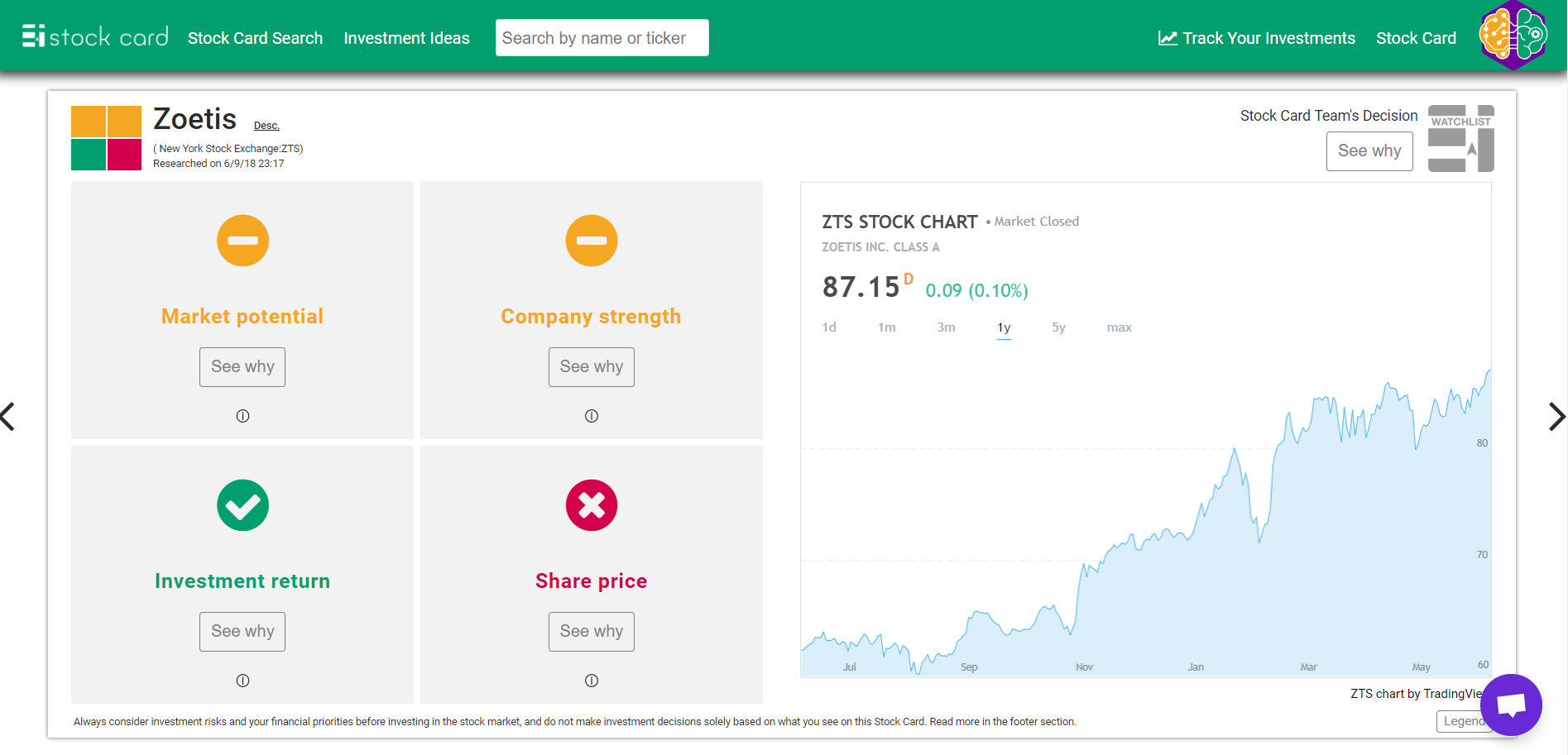

Other pet health related stocks include Zoetis (symbol: ZTS) and IDEXX (symbol: IDXX) for those of you who don’t know both of these companies are used widely by many veterinary hospitals (including all of the different hospitals where I have worked). Zoetis provides vaccines and diagnostic tests to many veterinary hospitals, whereas IDEXX is more focused on laboratory services across a wide variety of animal sectors (including livestock, poultry, dairy and water testing markets according to Markets Insider). IDEXX’s main competitive advantage (in my opinion) in the small animal laboratory services market is that they own Cornerstone which is the software used to manage overall operations in many veterinary hospitals. Making it easy for veterinary hospitals to choose to use their other services because it integrates with their software. While they certainly have competition, they are definitely highly integrated into veterinary hospitals and have a great comprehensive software for management and pet records.

Lastly, there are a few companies that were publicly traded, but have recently been acquired by private companies. For example, VCA (old symbol: WOOF). I would have preferred to invest in VCA prior to their acquisition by Mars for $7.7 Billion last year, so I might be taking a look at IDEXX or Zoetis as a stock to purchase next before more acquisitions occur and I miss out on potential opportunities!

Urban Life for Pets

Several Pet technologies have emerged in recent years that very much so cater to the urban pet parent (i.e. millennials). These companies provide solutions anywhere from pet at home entertainment to dog-walking apps like Wag. As a mater of fact, Wag has already closed several rounds of funding to boost their expansion including a $300 million round from Softbank in January of this year, and Rover closed it’s 10th round of funding ($125 million) two weeks ago.

Other pet technology companies I am really excited about include DogParker, PetCube and Bark & Co. Unfortunately, none of these companies are publicly traded yet, but I am keeping my eyes and ears open for news about possible IPOs or acquisitions. My somewhat new rule of investment is if I use the companies services regularly and enjoy being a customer (and can afford the stock price), I will usually buy shares. The only company I haven’t used yet is DogParker. However, when researching for this blog post, I was on their website and saw that they are looking for investors before they expand nationally in two weeks! (More on the type of investment below).

Pet Technology

Pet technology companies provide another very exciting emerging investment opportunity for pet parents. This vertical is vast and extensive, providing solutions from reducing pet obesity to helping pet parents manage their pet’s health more easily. Some of my favorite companies in this space are CleverPet, your pet’s smart puzzle to improve mental stimulation for pets, Pawprint the online pet medical record, Embark, the canine DNA test, and Whistle, the pet activity tracker.

Whistle was actually acquired by Mars Petcare in 2016, but Mars remains a private company and, therefore, consumers cannot yet buy stocks. Mars is also an interesting company to keep your eyes on because they recently purchased a European veterinary company AniCura for $2.36 Billion after purchasing VCA (see above) in 2017 for $7.7 Billion. While Mars itself might not be a publicly traded company, you can certainly look for trends of acquisition, and purchase stocks from companies that might get acquired by the big players.

Other Ways to Get Involved as an Investor

As you can see, many of these companies mentioned above are not yet public and, therefore, can limit your ability to participate in their success as an investor in the stock market. However, there are several other ways you can participate in pet company investments.

Crowdfunding

Keep an eye out for those Kickstarter and Indegogo campaigns. Many of these campaigns lead to the success of future companies, and offer you an opportunity to be a beta tester and early adopter. Not to mention, Indegogo allows your to participate in Microventures. Microventures is a platform for companies to crowdfund their expansion as the public participates in their funding rounds, and essentially acts like a small scale Venture Capital firm. For example, Cuddle Clones, a company many of my fellow pet bloggers have worked with, is now raising funding for Marketing, Product Expansion, and Investment in their online community.

Similar to what Indegogo is doing with Microventures, there are a myriad of platforms available online that allow you to invest small amounts of money in companies you believe in. We’ve seen this trend grow in recent years as IPOs have decreased. Even companies from the BlogPaws community like PetHub are equity crowdfunding on platforms like Crowdfunder.com to fund new milestones and future growth.

Harrison Ford staying up to date on world news so that he can adjust his portfolio accordingly.

Angel Investing

Microventures allows you to invest as little as $100 in a company you think has potential and can succeed in their market and expansion. Angel investing can however, require larger amounts of capital invested upfront. For example, this campaign on SeedInvest (they didn’t have any pet-related investments) requires a minimum investment of $500.

AngelList offers 3 different investment products; syndicates, funds, and a professional investor program. The typical investment size for a syndicate can be between $1,000-$10,000, however, to participate in these types of investments, an investor be accredited.

While Angel Investing might seem like a daunting task, it might be a great way to invest your money in companies and industries you believe in!

I hope you enjoyed this brief synopsis on what’s going on in the pet industry. Please let me know in the comments below if you found this blog post enjoyable.

Additionally, I would love to hear your thoughts on pet-related investment strategies.